While you’ve probably heard of iconic African-American historical figures like Martin Luther King, Jr. and Billie Holiday, the d/Deaf communities often do not receive the same recognition. In honor of… Read More

While you’ve probably heard of iconic African-American historical figures like Martin Luther King, Jr. and Billie Holiday, the d/Deaf communities often do not receive the same recognition. In honor of… Read More

At the beginning of the Fall 2023 semester, TypeWell polled active transcribers to gauge how much work they were assigned, what kinds of work they were assigned, and how they… Read More

Before diving into the complexities of our industry's current state, I'd like to take a moment to reflect on my last post, 'Speaking of AI: Why I'm Confident in the… Read More

Andrew Hansen has been a TypeWell transcriber since 2008. He completed the Turbo Courselet in 2011 and attended the Professional Development Symposium in 2012. Andrew completed TypeWell's formal Skill Assessment in early 2017… Read More

For educational professionals working with deaf and hard-of-hearing (D/HH) students, a pressing question arises: At what reading level are students ready to benefit from meaning-for-meaning transcription services like TypeWell? It's… Read More

Andrea Drummond, a certified Teacher of the Deaf and Hard of Hearing (TDHH) working in K-12 public schools in British Columbia, Canada, offers a deep dive into the intricate process… Read More

This summer: A special offer for C-Print captionists to discover the benefits of TypeWell! Are you a C-Print captionist looking to expand your skills and job opportunities? Now is… Read More

I firmly believe that human expertise in transcribing is essential for ensuring effective communication. Moreover, I am convinced that professional transcribers can maintain job security by being adaptable and… Read More

Summer is the perfect time to invest in your future and pursue new career opportunities. If you're interested in becoming a TypeWell transcriber or upgrading your skills, we invite you… Read More

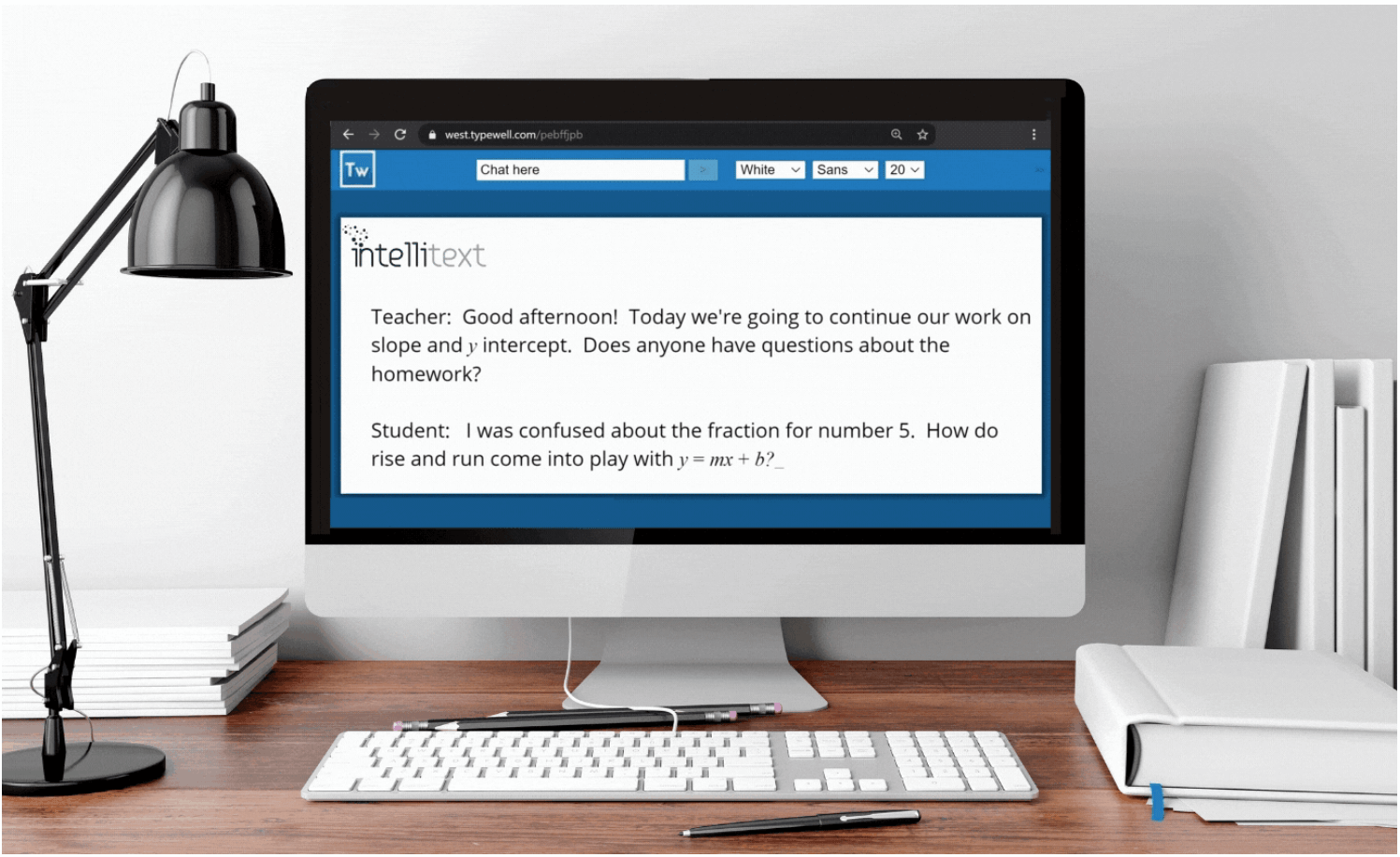

Intellitext was founded in 2011 to serve D/deaf and hard-of-hearing communities by providing real-time communication access in classrooms, businesses, and anywhere conversations take place. Randi Castro, the agency’s founder, worked… Read More